Fintech application programming interfaces (APIs) are known for transforming various financial industries. Financial software development companies adopt these APIs to get new financial services, applications, and business models into the market. To know more about it, let us go through this blog.

1. What are Fintech APIs?

The term “fintech API” refers to a set of processes that allow applications to connect to the data and services stored on the servers of financial companies or banks. APIs help in accessing data for the parties involved in financial transactions like third-party providers, banks, consumers, and websites. All the popular fintech applications in the market work on APIs that help them with real-time data access. Similarly, in the financial sector, APIs allow third parties to access data with the permission of the client. And this has completely changed the way the financial sector works.

The increase in the dominance of APIs in financial technology has made understanding this technology easier. For this, banks need to collaborate with third parties to expand their services. Merchants have to make it simple and easy for the clients to pay using their preferred payment option. These things are possible with the help of the fintech APIs. This financial API is utilized by the developers in creating applications for the banking and finance industry and makes services cost-effective & faster.

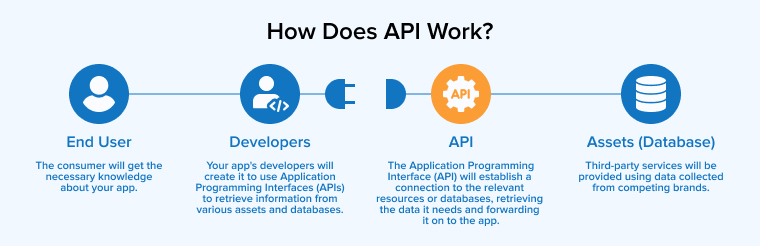

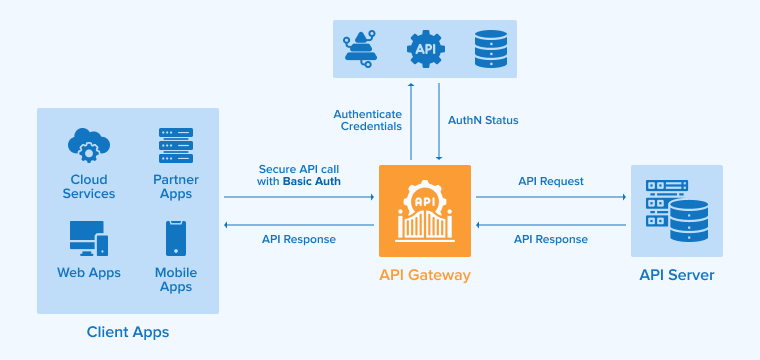

2. How Does API Work?

APIs act as mediators between different parts of software that are used to exchange data and this is the case in all the fintech solutions. The APIs for fintech applications come with a set of functions that can be customized for various purposes, enabling application developers to use them as building blocks for new software solutions.

FinTech APIs regulate the flow of information and communication between various financial technology platforms and third-party apps. To understand how they function, consider the following:

2.1 Request and Authentication

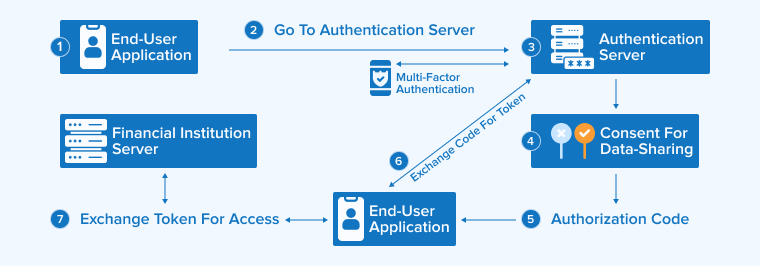

When a user uses a FinTech app or completes a financial activity, it creates a request. Tokens, keys, or other types of information are often needed for authentication in API banking technologies to confirm the user’s identity and authorization levels.

2.2 Data Retrieval and Processing

The API passes the request to the server or system that processes the FinTech. Examples of this processing include communication with third-party services, such as payment service providers or banks, or doing computations or retrieving databases.

2.3 Data Exchange

A response is sent back over the API by the FinTech system, once the fintech system finishes handling the request and collecting the appropriate data. Any pertinent data, such as financial details or confirmations of transactions, might be included in this response.

2.4 Integration

The receiving mobile app will either integrates that information into a display or add it into another actions.

2.5 Error Handling and Security

APIs in the financial technology sector contain robust error-handling systems to address validation errors, server outages, and erroneous requests. To further ensure the security of private financial data, API banking integration necessitates the use of many security measures, including encryption.

2.6 Continued Monitoring

To fulfill security standards, comply with regulations, and ensure maximum performance, it is vital to continuously monitor API-based banking activity.

3. Types of APIs You Can Use for Fintech App

There is a good probability that an API already exists for the functionality you want to add to your app. Learn more about the various APIs and how they may improve your finance app below.

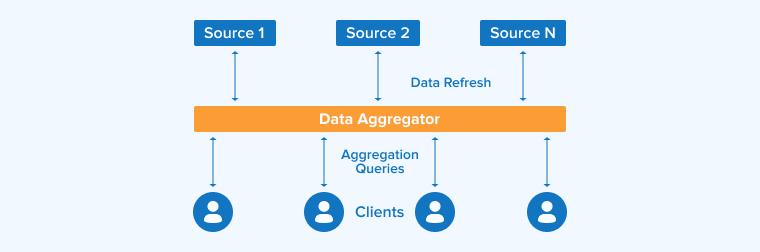

3.1 Financial Data Aggregators and Providers

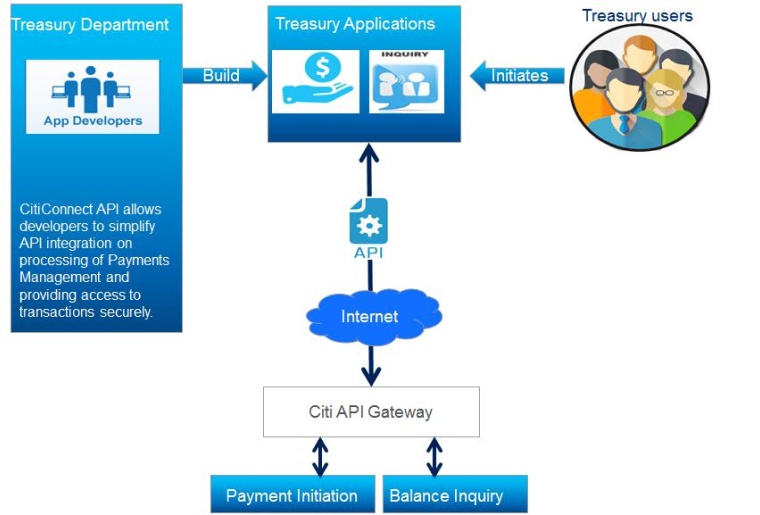

Via these application programming interfaces (APIs), third-party programs can have access to users’ monetary data, such as bank financial statements. In addition, some make it possible for third-party applications to provide banking and financial services.

APIs are available from most major financial institutions. For instance, Citibank offers a wide variety of APIs for developers to build apps that connect to their banking services, including account management, bill pay, and security.

The developer website also has a wealth of resources, such as examples and use cases, to help guide developers.

Although reliable and safe, APIs provided by individual banks can only be used for dealings with those banks. Data aggregators such as Plaid are preferable if you value adaptability.

They do the groundwork, including verification and validation, and have access to data from several financial institutions.

Financial data aggregators will certainly become one of the most crucial APIs determining the face of fintech as Open Banking projects are accelerated throughout the world.

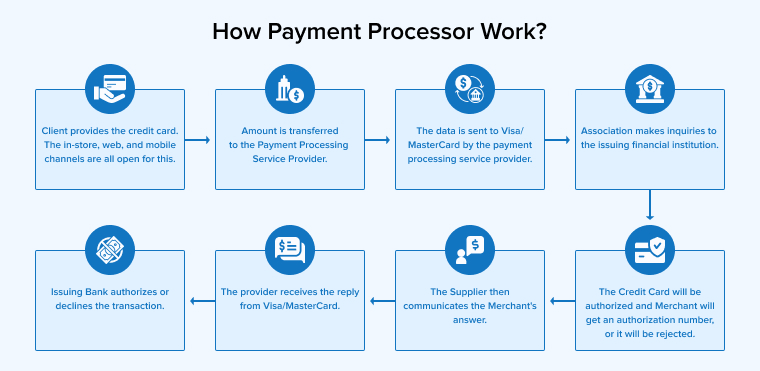

3.2 Payment Processors

When it comes to the impression that APIs have on the financial technology industry and the Internet economy as a whole, payment processors stand out as the undisputed frontrunners.

Digital transactions rely on these third parties to acquire, validate, and accept payment. Stripe, PayPal, and MangoPay are just a few examples of popular APIs.

A recent Statista survey found that the payment area was the top-performing fintech sector. This is not unexpected in the least, as payments are required by the vast majority of fintech apps.

To avoid the tedious details of processing payments yourself, a payment processor is essential. Among these are anti-fraud measures, security measures, and foreign exchange.

As a result, this is likely to be the minimum API level required going forward.

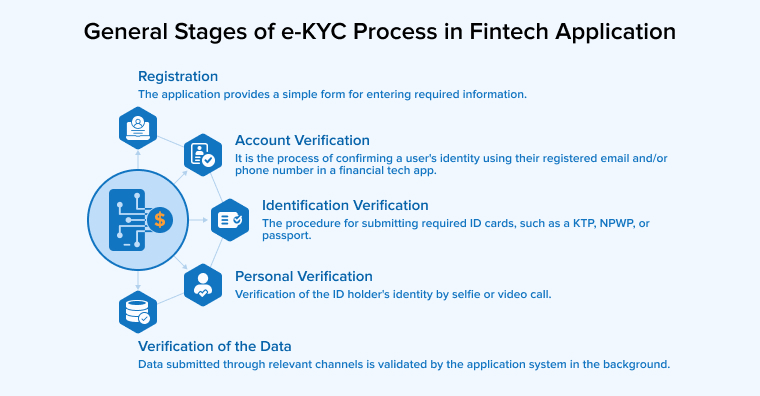

3.3 KYC and RegTech Tools

Despite its numerous obstacles, Know Your Customer (KYC) is a crucial practice for regulation in many nations.

Issues with KYC in your app might include longer onboarding times, higher expenses, and security worries.

Rather than having to manually handle identity verification and its various intricacies, you can let KYC tools do all the heavy lifting for you. For instance, ShuftiPro offers video interview KYC and face biometrics to enhance security against fraud and fake recordings.

Some services, such as Alloy’s, use AI and extensive client data to completely automate the Know Your Customer (KYC) process.

By automating formerly manual processes, RegTech is similarly contributing to the development of the compliance landscape.

There’s little question that in the future of fintech, compliance will be an arduous, time-consuming, and expensive need. However, there are ways to make it more manageable, and APIs for KYC and RegTech are one of those ways.

3.4 Authentication and Authorization Tools

Because of the prevalence of continuous cyberattacks on the financial services industry, security has become an integral aspect of fintech. As it is getting more complex, we need to keep improving our defenses against it.

Fortunately, security APIs exist and can be simply implemented into software. No need to stress over enforcing them on your own when you have these available.

Native technologies, such as Apple’s Biometric Authentication and the Android Biometric Library, are available for usage with biometrics. Moreover, you may increase security by implementing multi-factor authentication (MFA) with tools like the Duo Auth API.

Every part of your software’s ecosystem contributes to its security, thus APIs are limited in their capacity.

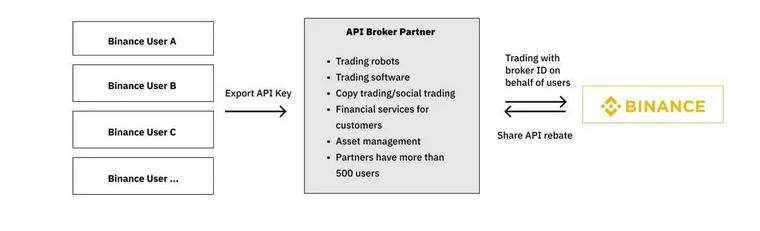

3.5 Investment Brokers

Developing programs for dealing in the markets is the most difficult component of developing investing applications, and that also comes with its risks. Several high-quality broker application programming interfaces (APIs) mean you won’t have to start from scratch.

Trading on the customer‘s side, broker APIs are analogous to their human equivalents.

APIs for brokers can provide a wide variety of services. Some, like Interactive Brokers, provide a comprehensive set of services that enable trading in virtually every market imaginable.

Others, like Polygon.io, exist primarily to provide extensive stock data. The cryptocurrency exchanges that CoinAPI provides access to cryptocurrency exchanges are a great starting point for anybody interested in learning more about cryptocurrencies.

Integrating investment tools into your app is straightforward using broker APIs. As a result, it’s simple to include other types of fintech apps, such as monetary management or electronic banking.

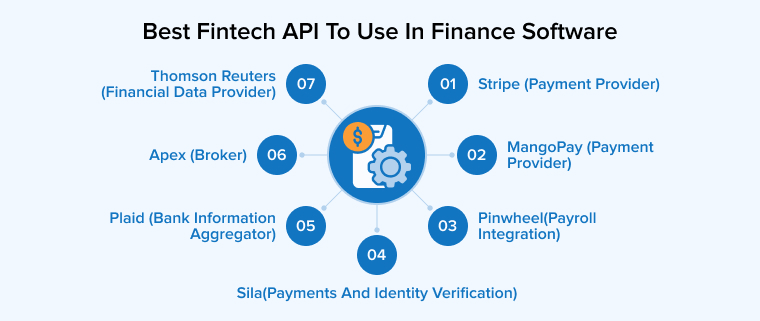

4. Best Fintech API To Use In Finance Software

Here are the best fintech APIs to use in finance software:

4.1 Stripe (Payment Provider)

Stripe is an API in fintech that enables users to manage and process online payments. It is also used by custom commerce and SaaS. It comes with features like securing transactions, consistent service, easy-to-use reporting features, and democratic fees.

Pricing:

- Stripe charges $0.30 plus 2.9% plus for each successful card charge online.

- When it comes to in-person card processing, it charges $0.05 plus 2.7% for each successful credit card transaction.

Stripe API Introduction – https://stripe.com/docs/api

4.2 MangoPay (Payment Provider)

MangoPay is a fintech API that is used by many fintech companies because it offers multiple currency payments with the help of various local payment methods. In this API, all the payment flows and commissions are automated and this is possible because of one single contract of MangoPay. It is designed in such a way that developers can easily integrate the payment solution on the business platform and this is because of the open-source SDKs.

Pricing:

- Pay-in per transaction charge is 0.18€ plus 1.8%

- Pay-out per transaction is free of cost.

Mangopay API Docs – https://docs.mangopay.com/

4.3 Pinwheel(Payroll Integration)

Pinwheel is a popular payroll connectivity API company that is used by the majority of fintech companies to securely access income and update direct deposits. It is an API that helps neobanks connect to a client’s payroll information system and enable services such as income verification, direct-deposit switching, and paycheck-linked lending.

Pricing: NA

Pinwheel API Overview – https://docs.pinwheelapi.com/reference/api-overview

4.4 Sila(Payments and Identity Verification)

Sila is an API platform that can issue an ERC-20 stablecoin known as SilaToken (SILA). Every transaction on the platform is done using this token. Sila enables the installation of international payments, card payments, business ID verification, and more.

Pricing:

- The Grow plan of this API is free but if you want access to its advanced features the price starts from $2000/month.

- The Scale plan of this API is also free but its advanced featured-system costs $10,000/month.

Sila API Overview – https://docs.silamoney.com/docs

4.5 Plaid (Bank Information Aggregator)

Initially, Plaid used to create financial service APIs that helped clients share their banking information more easily. But in 2018, they started offering their fintech solutions to a wider class of people. It can be used as a bank information aggregator, streamlining bank account authentication, fraud prevention, user income validation, comprehensive transaction history, and transaction geological tracking.

Pricing:

- Plaid comes with two payment options – Scale and Launch.

- The Scale version costs $500/month and for the launch version, you have to pay as you go.

Plaid API Reference – https://plaid.com/docs/api/

4.6 Apex (Broker)

Apex comes with a robust and booming suite of APIs that helps in investing and trading for lifecycle starting from bank account opening and more. This fintech API is used by many fintech startups because it enables the users to execute across various asset classes like book-keeping, fractional order, and stock locate support.

Pricing:

- To know the payment details, the user has to send a request for a quotation.

Apex Developer Home : https://www.apexclearing.com/solutions/#apexConnect

4.7 Thomson Reuters (Financial Data Provider)

Thomson Reuters provides critical information that helps in deciding the legal, financial market data, tax, and media sectors. The tax and accounting APIs offered by this company include –

Checkpoint — It is an online research suite that has the capability to source various tools, materials, and news.

Onvio — It enables the cloud-based software to offer real-time access to billing, documents, and projects.

Pricing:

- The fees of these APIs are available on request.

Thomson Reuters Developer Portal – https://developerportal.thomsonreuters.com/?page=4

5. How To Choose The Right Fintech API Provider

There are multiple fintech API providers in each category. Even if you know the specific type of API, you could be asking how to choose among all of them. To help you decide, we have compiled the following list of criteria:

5.1 Cost-Efficiency

Check the expense compared to the specifications to make sure it fits your budget and gives you good value.

5.2 Examine Performance and Durability

Downtime costs money, so make sure to look at the contenders’ uptime records and how they handled heavy loads in the past. For inside information about customer support help, look at customer review sites or talk to their current customers. Make sure the API will expand without any problems.

5.3 Easy Integration and User-Friendliness

Try to find APIs that are easy to integrate with your current systems and come with detailed, understandable documentation.

5.4 Check For Advanced Development Tools and Documentation

With comprehensive developer tools like software development kits (SDKs), sample codes, and tutorials, developers can grasp the reasoning behind upgrades and swiftly integrate the FinTech API. Analyze the business’s community involvement as well: You can find out a lot about the business’s popularity and dedication to its products.

5.5 Check For Safety

To ensure the safety of your fintech app’s API, search for integrations that use proven security methods such as encoding, verification processes, and access controls. Respected API suppliers in the financial technology sector should adhere to industry regulations, including PCI DSS, GDPR, and any regional equivalents. Additionally, to facilitate future migrations and reduce risk, review data ownership policies to make sure your company’s data remains under your control.

5.6 Customer Service

Think about the provider’s position in the industry and the quality of their customer service, since these things show how reliable and satisfied their users are.

Evaluate each solution based on these criteria to ensure it satisfies your goals and helps the growth of your organization.

6. Benefits of Fintech APIs in Finance Software

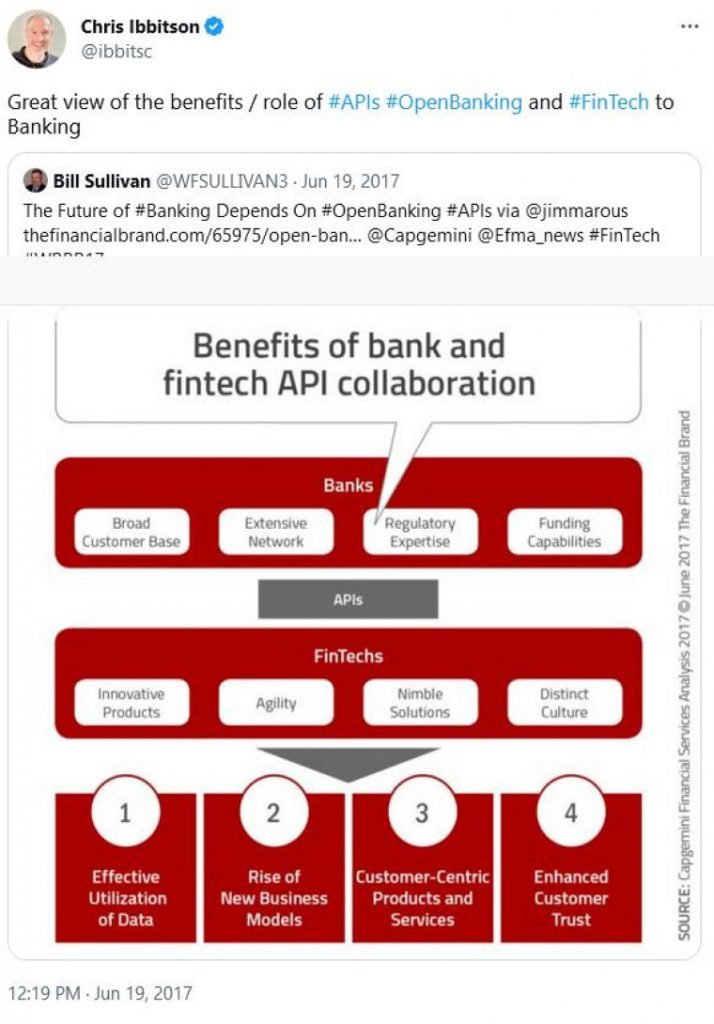

Here’s a tweet from Bill Sullivan describing the benefits of Fintech APIs through a brief chart:

Some of the top advantages of fintech APIs are –

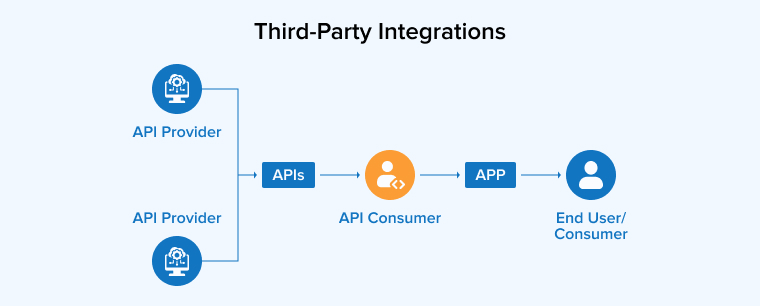

6.1 Third-Party Integrations

In the fintech industry, users are in constant need for new services, and developing such services is quite expensive. Therefore, many companies use services available through third-party integrations that are offered through APIs.

6.2 Security and Compliance

Many countries have introduced rules and regulations for financial organizations to offer third-party services that can help in accessing clients’ data and this is all to support the open banking concept. Fintech APIs have the capability to work with both open and sensitive data, providing security and regulatory compliance to financial institutes.

6.3 Data Accessibility

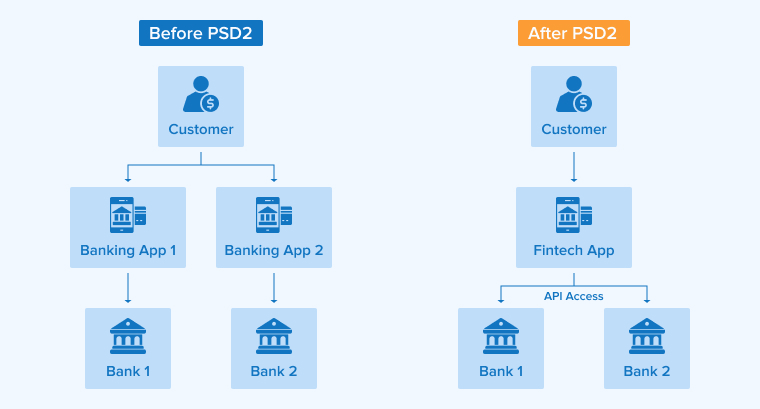

In this digital world, keeping data secure or hidden from the public is difficult rather than impossible. And for this, PSD2 was introduced. But it has also made it difficult for the users and programs to access important and required data. PSD2 enables third parties to access financial data. This means that the third parties have the right to access user data or manage data is possible because of GDPR and PSD2. Because of this users, now have the legal right to understand how their personal finance app or financial information is used.

6.4 Enhanced Customer Experience

In the financial technology sector, APIs play a crucial role in improving the client experience. They pave the way for the development of banking apps and services that are more tailored to each individual’s needs while also being easier to use. By highlighting the essential elements that set their apps apart, API developers can optimize the user experience with the help of FinTech APIs.

Nowadays customers can access and engage with their financial data aggregation in different ways because the FinTech industry has the potential to improve the user experience. As an added benefit, these solutions make it easier for clients to exchange funds, get loans, and manage their accounts through various channels by integrating various financial systems. Customer experience and engagement can significantly improve as a result of less hassle and more ease for consumers.

6.5 Fast and Efficient Operations

With the help of API solutions in fintech, companies are able to quickly add new features in the application and also help in accelerating the launch of new services. Besides, they also help in creating customized API functions that can fulfill a specific purpose.

APIs also help clients to manage their banking transactions easily through online banking, mobile banking, and digital wallet services. Fintech APIs enable 90% of the physical bank transactions that are happening in banks to be carried out digitally and this can save a lot of time.

6.6 Cross-Platform Availability

Financial institutions use APIs to offer cross-platform support to their users. Desktop, mobile, and wearable app versions allow seamless client support.

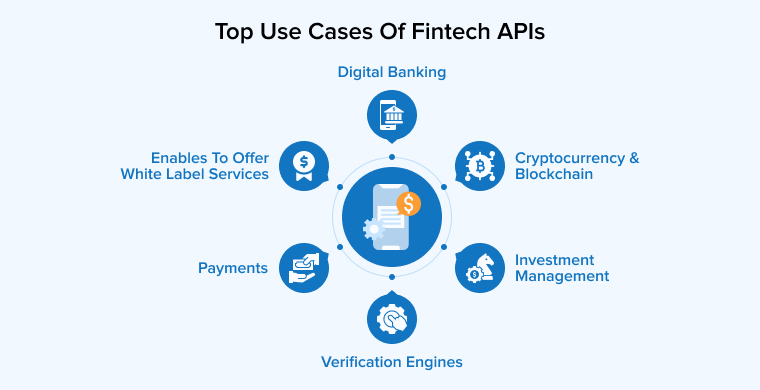

7. Top Use Cases of Fintech APIs

Top use cases of fintech APIs –

7.1 Digital Banking

With time, mobile banking has become a very important part of the financial industry. As neobanks like Revolut and GoCardless are on the rise, the majority of financial institutions are going mobile-friendly. This attracts a diverse customer base which makes it easy for them to manage their financial account information, financial transactions, data analytics, and many more.

7.2 Cryptocurrency & Blockchain

Cryptocurrency is a concept that has brought a new evolution in the financial services industry and has made users rethink the way they engage with money. With blockchain being the technology behind cryptocurrency, sharing and storing financial data has been very secure. This has been very beneficial for all financial institutions.

7.3 Investment Management

Fintech has also changed the world of investment. It has made investing easy with the help of various applications. There are applications like Robinhood in the market that make it easy for users to invest their money and learn everything about the markets.

7.4 Verification Engines

Initially, when users submitted their information for verification, the task was carried forward by several staff members.

7.5 Payments

With the help of fintech, payments have become real-time. Nowadays, every business organization allows its users to make payments using digital payment processing services. This is possible because of the API integrations into the businesses’ payment processors. For this companies like Venmo, PayPal, Stripe, and Square have been very useful.

7.6 Enables to Offer White Label Services

Many companies in the market offer branded APIs but there are also white-label APIs that are available for both fintech companies and banks. These APIs enable financial firms or traditional banks to utilize the benefits of these APIs without the need to create their programs and platforms.

7.7 Fintech APIs Future

After observing the current situation and the use of banking APIs, companies and broader communities appear to have a bright future. Naturally, tomorrow will provide a more favorable result. This is because these banking APIs are connected to e-commerce platforms, making online purchases a breeze. In addition, they help clients see the funds in their bank accounts instantly, which is useful for creating payment plans and organizing purchases.

8. Final Thoughts

As seen in this blog, fintech APIs are the most important parts of the fintech revolution that can help businesses introduce new ventures and innovative services. These APIs are available in all sizes for both small fintech companies and large organizations. These APIs are known as gateways for developers as they help them in making applications and services reliable and fast.

Thanks for sharing this informative article on the best fintech APIs. With the growing demand for digital financial services, these fintech APIs are becoming increasingly vital for the financial industry. With the rapid growth of the fintech industry, these APIs will play an important role in shaping the future of the financial industry.

I found this blog post to be very informative and helpful. It's extremely significant to have an in-depth overview of the top fintech APIs for financial software. Since I was previously unaware of this, I found the section on the advantages of using fintech APIs to be of special value.

Fintech APIs are an effective tool that firms may use to develop and enhance the financial services they provide. Fintech APIs give organizations a method to connect to financial data and services, which may help them develop new products and services, increase the effectiveness of their current offers, and enhance client experiences.