Fintech companies are flourishing with innovations and newer ideas are getting shaped into apps. Now, the role of Fintech has become more defined, reasonable, and vital. If you think you can’t keep up with all financial buzzwords from Ethereum and Bitcoin to NFTs, then don’t panic, you are not the only one. The ever-growing spur of Fintech has been continuously innovating to develop customized financial software solutions. Everything you do, even the smallest financial transaction highly defines the value of fintech within businesses.

Fintech cannot be taken as just another innovation, it is here to stay, innovate, and change the current way of operations. Thus, this necessitates us to have a good understanding of financial services, mobile payments, online trading, mobile banking, payment methodologies, third-party app integration, secure payment services, and similar other needs. Don’t be afraid, you will get to know about each of these in this blog. But, firstly let us start with the basic question- what is Fintech?

1. What is Fintech?

Fintech or financial technology means offering financial services over the internet. Everything right from mobile banking apps to mobile payments apps, blockchain, cryptocurrency, stock trading, etc can be included in this fintech innovation. In simple words, every business can use fintech for their services and enhance or automate their work and procedures. Wondering why? Because with this you can simply offer exclusive financial services to both businesses and consumers at once.

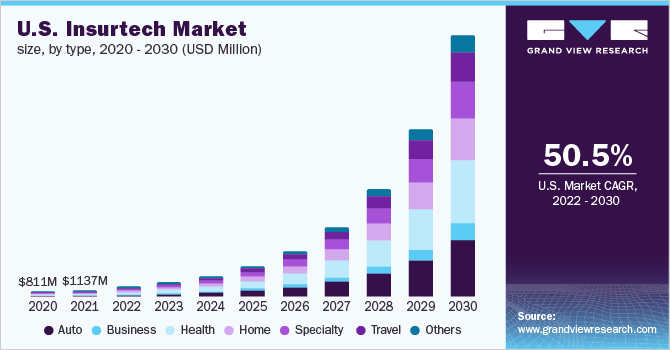

Fintech is a phrase that’s not a short-term buzzword and whose significance can not be denied. Over a few years, a radical change has been observed in the way we manage our business and even personal finance – all thanks to the ever-growing financial technology company. Here’s what the Google Trends report is showing us about Fintech search terms.

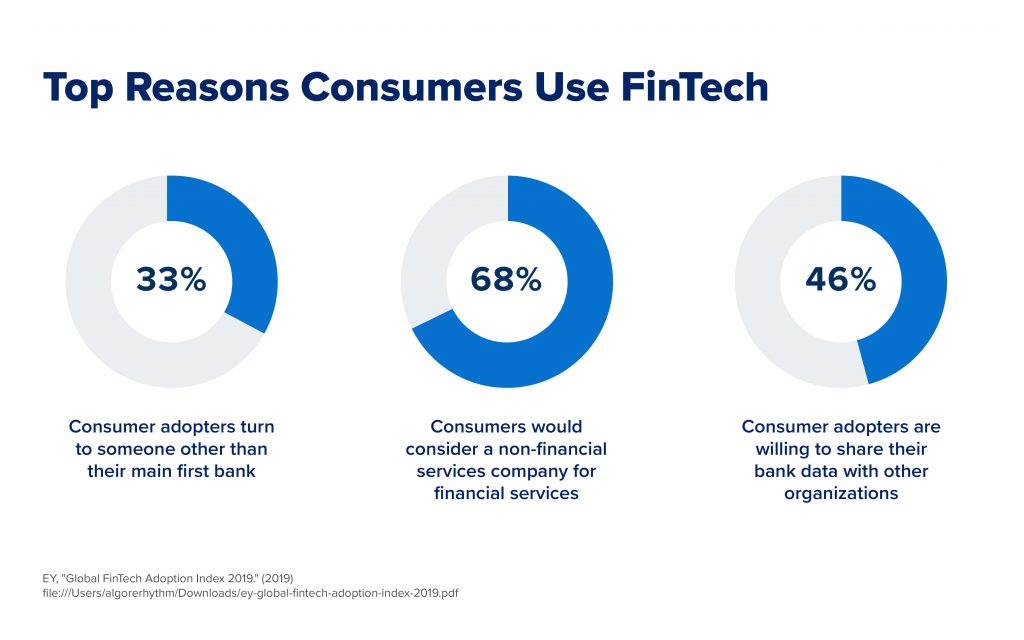

Along with this, more and more fintech(financial technology) companies are found making financial services more accessible to the general public. Everything from traditional financial transactions, such as investing, saving, and loan processing, are also included in these digital financial services. Take a look at the CNBC report on Fintech.

In layman’s language, this one seems to be now making a million-dollar industry. With this, we can assume that fintech as a service is quite a powerful and money-minting financial services industry if you know how to take the lead. Also, you are halfway done when you realize and act upon utilizing the best from the Fintech companies.

2. How Does FinTech Work?

Traditional financial services are made available to consumers and companies through fintech in ways that were not possible before. The mobile applications of many traditional banks, for instance, now provide convenient, on-the-go access to a variety of banking functions, such as checking account balances, transferring payments, and even depositing checks. In the meanwhile, robo-consultants like Betterment provide an alternative to traditional financial advisors that is both cost-effective and easy.

Several services used by organizations are made easier thanks to automation brought forth by FinTech. Fintech companies can better understand their clients because of the combination of artificial intelligence and large amounts of consumer data, which in turn fuels marketing, product design, and underwriting.

3. Fintech Trends

The financial technology sector is not a new one, but it has developed rapidly in recent years. Whether it is the advent of credit cards or ATMs, electronic trading platforms, personal finance applications, or high-frequency trading, science has always played a role in the financial sector.

The financial technology sector, however, has expanded rapidly over the past decade, and its innovations are only expected to get better going forward.

The following are some emerging areas in fintech that you should keep an eye on:

3.1 Mobile Payment Systems

Apple Pay and Google Pay are two examples of digital wallets that enable users to keep their account data in a mobile app and then use that app to make purchases. Even though digital wallets have been available for some time, their popularity is growing.

3.2 Blockchain in Fintech

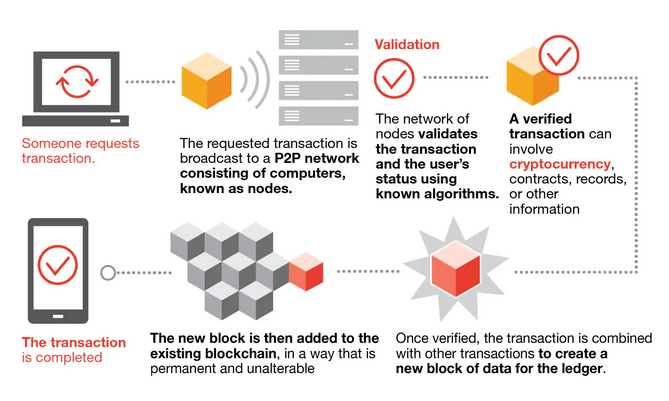

The financial sector will likely be affected by blockchain, a public ledger that can track the provenance, origin, and transfer of digital assets. To begin, advances in ledger technology and the widespread adoption of smart agreements will go a long way toward improving safety and productivity within the sector.

3.3 Financial Inclusion

When a company outside of the financial sector employs fintech solutions at its point of sale, this is known as embedded finance. Coffee shop POS systems accept payments, and online retailers sometimes provide “buy now, pay later” options. We’ll probably see more and more businesses adopting an integrated financial stack like this in the near future so that they can provide their clients with a more streamlined, adaptable experience.

3.4 Prioritizing the Needs of Underserved Communities

Fintech’s grand pledge is that it will make traditional banking more accessible to those who have never experienced it before. A number of fintech firms are working to break down barriers that have existed in the financial sector for decades, making it easier for individuals, especially millennials and people of color, to save money, invest, and amass financial security.

4. Examples of FinTech

Since we have covered the basics of fintech now it’s time to be precise. Can you name two or three top fintech companies? Wealthfront, Personal Capital, and Kabbage are the ones to top the list at present. All of them have significantly been offering unmatchable fintech services to the financial services sector and retail banking industry. For better understanding let us go through these common yet important examples of fintech.

4.1 Online and Mobile Payment Systems

There is no denying the fact that Fintech companies have made some significant changes in the way we buy and sell products – both as businesses as well as individuals. Conducting transactions via smart devices and computing systems was a pure myth at some point in time and today it has become a reality.

Today if you ask anyone whether he is a 35-year-old job worker a college-going kid or a 60-year-old retired businessman, how would they like to make payments? They would say by using mobile payment apps be it Google Pay or WhatsApp payment or anything else. In India, our IT minister Ashwini Vaishnaw uses his Twitter handle to broadcast the rise of UPI payment which is one of online payments.

🇮🇳 records 6 billion UPI transactions in July. pic.twitter.com/QL8O95jEWf

— Ashwini Vaishnaw (@AshwiniVaishnaw) August 2, 2022

The cash-based society seems to be doomed, which is not a problem at all. Because these online transactions have led to several benefits such as corruption has decreased, a few underdeveloped banking sectors have gained momentum, managing finances is no longer rocket science and whatnot.

4.2 Trading

Of course who doesn’t believe in trading and investment? After all, this is one of the sure-shot and safest ways to multiply your money in the least amount of time. With the rise in fintech, by using emerging technologies such as Artificial intelligence, Machine learning, natural language processing, DLT(Distributed Ledger Technology), and big data, gaining relevant insights is no longer difficult.

Also, you will come across a wide range of stock trading apps where not just transactions can be carried out but also assets can be managed easily.

4.3 Blockchain and Cryptocurrency

The list is incomplete without Cryptocurrency and blockchain. Buying or selling bitcoins has now become a new norm to reduce fraud or faulty transactions and safeguard financial data on Blockchain technology. Have you heard about Libra? It is Facebook’s digital currency. So you see the concept of cryptocurrency is not slowing down.

4.4 Crowdfunding Platforms

First, what are these crowdfunding platforms? These platforms enable internet or app users to send or receive money from different digital platforms at the same time. Yes, you are no longer required to beg in front of conventional banks for loans, all you have to do is find investors who are ready to support you, and your work is done.

GoFundMe and Kickstarter are certain examples to take into consideration here. Whether you want to pay hospital bills travel or conduct fundraisers or any such charitable events, crowdfunding platforms can be extremely helpful.

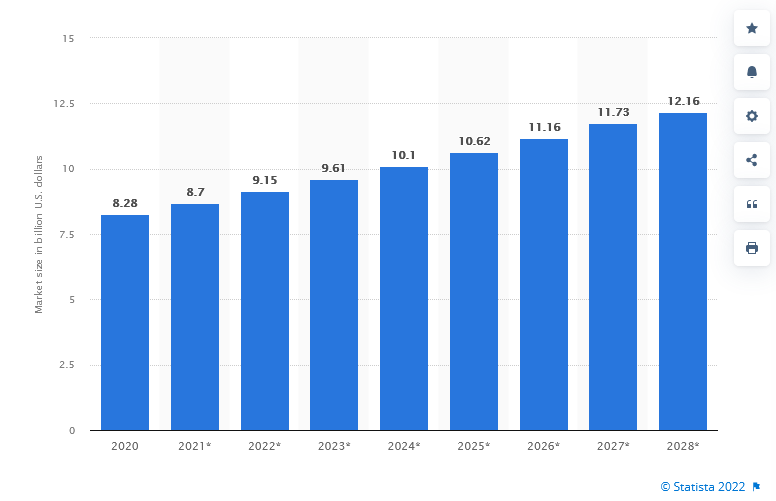

4.5 Insurtech

Lastly, we have Insurtech. Fintech is not just limited to the financial institutions or the banking industry, it has created a huge impact on the insurance industry as well. Insurtech is the name being reckoned with again and again. And why not since this one has left no stone unturned in maximizing savings?

More and more fintech companies are found collaborating with insurance companies to streamline procedures and enable them to focus on other interesting aspects.

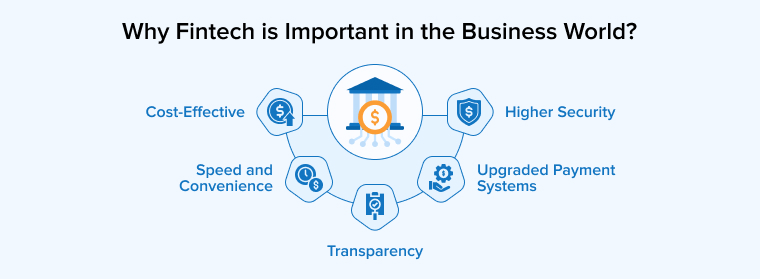

5. Why is Fintech (Financial Technology) Important in the Business World?

Businesses are no longer limited to implementing old-school ways or conventional ones, all thanks to the fintech revolution. Today one is surrounded by a plethora of alternatives and options ranging from crowdsourcing to net banking to mobile payments. More or less, unlike earlier, now anyone can set up his or her own business in no time with the help of fintech.

For those who don’t know what Crowdsourcing is? By using such financial services anyone can create instant plans on how and most importantly where to get finance from. Here you don’t need to meet others in person. Instead of spending so much time convincing your investors today, businesses can pitch seamlessly.

Transferring money across borders was a curse earlier! Time to get acquainted with TransferWise – the innovation that turned the table entirely. Not just large enterprises but even startups are found moving cash conveniently at cost-effective rates.

you won’t find the post convincing till I don’t provide some accurate reasons stating how important the Fintech software is. So without any further ado, here it goes!

5.1 Cost-Effective

Of course, you are well-versed with the fact that global payment services have proven as a pure blessing for a plethora of communities. But what you may not know is that global remittance is a costly venture and not every business has the potential to afford it.

Moreover, each time you transfer the money the processing fees automatically fluctuate. Using Fintech services, businesses could save from charging these unnecessary fees. There are a plethora of financial tools available. So, one no longer has to worry about any cancellation fees or any other hidden charges, they can send or receive money across the world instantly in different currencies through mobile devices.

Lastly, can anything think of integrating physical and digital payments? Well, now this is a reality where multiple bank accounts are using a single interface. And you know what is the best part? This fintech software is beneficial for consumers as well.

Atom is the best example I could think of as of now.

5.2 Compliance + Security = Fintech

Many of you might not agree that Fintech is highly safe in regards to security. Fintech is much safer and more secure than traditional banks.

According to several sources, traditional financial services companies have lagged way behind in regard to security. Unfortunate but that’s true! Now since Fintech’s fundamentals include the effective use of tech, compliance and security won’t be such a problem.

5.3 Upgraded Payment Systems

After security comes the upgraded payment systems. We are living in a dog-eat-dog world, if you want to raise a cut above using fintech software turns out to be a must-do thing. As a result, nothing can stop your business from being effective. Which is possible only by using upgraded payment systems. Also, this leads to enhanced business-client relations and increased ROI.

5.4 Speed and Convenience is Best for Companies as well as Customers

Since we mentioned this earlier, offering instant results and taking care of your customers has become a priority for every industry, and FinTech is no exception. Now it has become possible to offer payments or lend money right away digitally in no time. For example, let us assume that you want short-term loans or some money just for a day. We know you will come across a wide range of potential businesses that you would like to offer. These are the ones making the most of the tech and maintaining the economy.

5.5 Transparency

With the rise of Fintech in the traditional banking and financial services sector, the term transparency is no longer just said. It is being meant and implemented by the vendors. Several new benchmarks have been set by vendors all across the globe. Other than just sending or receiving money everyone is kept in a tight loop featuring full transparency. A win-win situation for the banking industry as well as their valued customers.

Of course, you do get all the other perks such as 24/7 dedicated customer support, real-time updates tight security measures, and whatnot!

6. How Fintech Is Beneficial For Economic Growth!

Till now, you must have realized the fact that how fintech innovations can make everything around so easy and effective. On that note, a recent IMF report entitled The Promise of Fintech: Financial Inclusion in the post Covid era reveals that those countries often have high annual GDP growth and beliefs in investing higher levels of digital financial inclusion

6.1 How does Fintech Contribute to Ever-Changing Economic Growth?

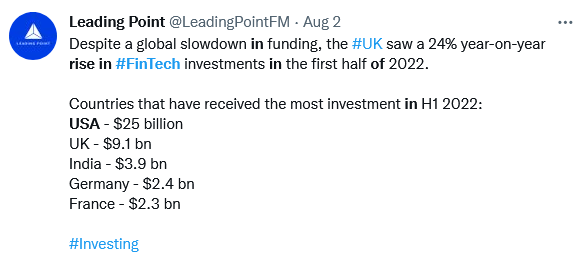

To begin with, it reduces overall transaction costs. Another benefit is increased GDP and job opportunities. Further, Let’s take a look at the Top three countries having a good number of fintech startups.

- The USA – A considerable rise has been observed among companies offering digital currency services here.

- The UK – Many fintech investments have been made in the UK, especially after the COVID massive hit and it is showing no signs of slowing down.

- Singapore – The Singapore government has already invested a significant amount in the ongoing as well as upcoming fintech projects.

Lastly, Innovations in digital banking, fintech lending, and equity or debt crowdfunding platforms have been pure bliss for banking and established financial institutions as well as their customers.

6.2 What Scope of Activities Does This Fintech Cover?

- Loans – There is a massive difference between the operating methods of banks and financial institutions now and then. You will be able to spot several Lending club(loan) markets.

- Payments – With the rise of the internet and mobile technology, mobile payment now can be easily done. In fact, online payments whether it’s to shop or buy food or book tickets cannot be underestimated. Transfer of money is now possible with fewer conversion fees and no fraud.

- Managing the Funds – With the emerging technology, it seems that we humans have changed to a great extent in regards to our habits especially how we save money, invest or manage them.

7. Conclusion

Brace yourself up as the fintech companies are going to get bigger and better. Let’s keep our fingers crossed and keep watching the space to know more about what exciting lies ahead in the Fintech space.

Amazing post! The details that you have mentioned in this article were very interesting and helpful. I really liked that you covered how fintech changed the whole industry, how mobile devices help lead the businesses, and how fintech is cost-effective than traditional services. Keep writing more!

Really very happy to say, this post is very interesting to read. It explains everything in detail, and in a very effective manner especially the Importance of fintech part that you mentioned in this article. I think the adoption of the new technology in the fintech sector will change the entire scenario of the financial industry.

Thank you for sharing this informative article. I truly think that fintech is going to stay here for longer period of time because every financial service provider is now adopting Fintech and it will become even more popular. More and more utilization of Fintech in applications will make easier for users to do their daily transactions. I think such innovations are boon for everyone.

Fintech is a combination of finance and technology that has reshaped traditional financial services. Fintech has enabled people to access a variety of financial services on their mobile devices, improving the convenience, security, and affordability of financial transactions. Thank you for sharing this useful insights on fintech.

Fantastic article on fintech! I'm interested to see how the fintech industry will continue to transform the conventional financial services business and make financial services more accessible to everyone.

Thank you for sharing this informative article on fintech. With the revolution of technology in the financial sector, we can transfer money at our fingertips, pay bills, easily take out a loan from a bank, and much more. It is continuously expanding and will become an automated way to manage financial services.