The invention of a convenient, user-friendly, and secure online money transfer app has revolutionized the financial software development services sector. With that, the only thing you require for any monetary exchange via a mobile app is an internet connection. Banks and other financial institutions may benefit from custom money transfer apps by giving their users a simple, quick, and safe way to send and receive money both locally and internationally.

If a money transfer system is to succeed, it must provide a trustworthy, effective, and legally compliant infrastructure for its users. But what if you don’t know the proper way to develop a money transfer app?

Read along and you will discover numerous beneficial insights while you study this article.

1. Why to Create Your Custom Money Transfer App?

1.1 Huge Demand

“The worldwide peer-to-peer (P2P) payment sector was expected to be worth $1.89 trillion by 2021, according to an analysis by Precedent Research. The market for money transfer applications is anticipated to be worth roughly $9.87 trillion by 2030.”

Mobile payment services are rapidly growing in popularity, with over 2.5 billion customers. Instantaneous peer-to-peer monetary electronic transactions are a sociable and practical means of exchanging money among individuals. The strong demand for speedy digital payments that surged during the epidemic isn’t going away any time soon.

1.2 Rapid Digitalization

People in today’s fast-paced society often find themselves unable to settle in one area for very long. The world is becoming increasingly digital and portable.

Why bother with the hassle of standing in line at a traditional bank to transfer money? Instead of using paper checks, consumers might use a convenient smartphone app to send and receive payments. The digitalization of banking simplifies money transfers and Internet payments. Money transfer apps now offer additional features such as insurance, blockchain, cryptocurrency, payment splitting, and digital savings accounts.

There’s a great chance that this will lead to new and useful applications. The financial technology sector will continue its meteoric rise for the foreseeable future. This indicates that your company has great growth potential and the ability to attract new consumers if you can stay up with current fintech trends while maintaining your product useful.

1.3 Financial Inclusion

Developing a fast P2P payment app appears very potential for more than just one cause: demand. As a matter of fact, in some nations and regions, this may be the only method for the unbanked to have a connection to financial services. Statista reports that Morocco, Vietnam, Egypt, the Philippines, and Mexico have the world’s highest rates of unbanked residents.

1.4 Online Banking for Business Needs

Not only may people utilize money transfer software nowadays, but corporations can as well. Businesses and ordinary consumers alike might benefit from a smartphone app that facilitates money transfers. Money transfer app development significantly increases the potential for new business partnerships to form and the neo-banking industry to expand further.

1.5 Significant Investment

If you approach it in the proper way, you should have no trouble securing money for your project. With an MVP or other related results, you can attract investment.

1.6 Innovations

P2P payment systems must utilize cutting-edge technologies to safeguard financial transactions and client information. As your team works to create a financial solution, they will get experience in cutting-edge areas of software engineering.

Given the availability of cell phones and the Internet, it’s reasonable to predict that peer-to-peer payment applications are going to be in consumption.

2. Types of Money Transfer Apps

It is important to understand the various sorts of money transfer apps before going on to the discussion of their foundational characteristics.

P2P payment systems, often known as person-to-person online transactions, occur between users of separate software programs. This implies that only one user at a time can send funds from their bank account or credit card using the app. The most widely used peer-to-peer (P2P) payment systems currently include mobile operating system (OS) platforms, standalone banks, and Internet banking services. Let’s quickly go through each of these categories so you can pick the business strategy that works best for you.

2.1 Mobile OS Systems

You might not realize that P2P services like Apple Pay and Android Pay are commonly used examples of mobile OS systems. The app’s success may be attributed to the convenience of making contactless payments for goods and services everywhere NFC technology is accepted. One problem, though, is that Android and Apple users may only send money to other Android and Apple devices.

2.2 Independent Services

Independent industry leaders like PayPal and Venmo offer such a set of services. These unique services offer customers P2P payment options through electronic wallets that accept bank cards.

Users may maintain their funds without ever touching their bank account thanks to such services. In general, Visa and MasterCard are accepted by all standalone services. However, this is subject to the particulars of the P2P service in question.

2.3 Online banking services

No industry understands this more than the baking industry, which is preparing for the inevitable decline of the old financial system.

Banks are competing with one another in the digital arena by being on the cutting edge of technology. This has led to an increase in the number of companies offering P2P services. Such bank-centric apps include Zelle and Dwolla.

3. Must-have Features of a Money Transfer App

You may send money to friends and family without using your bank or credit card when you download a custom money transfer application. Users may make cashless payments, trade currencies, and conduct other banking operations.

Apps that facilitate the transfer of funds provide several useful functions for both companies and consumers. These applications make it simple and fast to send money to loved ones or business associates.

You may use them to make in-app purchases, perform banking transactions, top up your mobile recharges, online payments to merchants, exchange currency, and even pay your bills, saving you time and eliminating the need to carry around cash. The most important ones are detailed here.

3.1 E-Wallets

As was previously noted, an electronic wallet allows users to store electronic money and banking information within the payment app itself, as well as conduct financial transactions.

3.2 Bill Payments

Future clients will expect to be able to pay bills online at any time and from any location, making this function essential. Bills are always viewed as a bother. With this improvement, your product will stand out from the crowd and appeal to a wider audience.

3.3 Payment Statistics

This function is crucial since information is paramount. By organizing user transactions by amount, status, nation, and recipient, users are better able to keep tabs on their financial situation. The final product is a simplified procedure that grants access to personal financial records.

3.4 Transaction Notifications

Functionality and brand loyalty are both boosted by this addition. Updates, alterations to accounts, wallet modifications, and exclusive offers and discounts may all be communicated via pop-ups, push alerts and texts.

3.5 Money Transfers to/From a Bank Account

Users must have access to their respective bank accounts in order to fund their e-wallets or, conversely, perform transactions, and retrieve their money, as in the case of cashback.

3.6 Expense Tracking

This feature is useful since it aids users in better managing their funds. Making a visual depiction of all financial transactions and organizing them by number, type, geography, etc. The end result is an improved user experience and financial savings for the customer.

3.7 Security and Fraud Protection

Security measures might include more than simply two-factor authentication. In addition, you may implement data encryption, fraud protection, and detection solutions that utilize artificial intelligence and machine learning by developing a blockchain-based money transfer application.

3.8 International Transfers and Currency Exchange

Conventional methods of monetary transmission sometimes require longer processing times and significant delays.

In addition, while foreign transfers have been a common practice in modern banking, traditional banks frequently require consumers to physically visit a branch in order to initiate such transactions. But with the help of online transfers via a mobile banking application, customers will be able to swiftly deposit and collect money through a few simple taps on a mobile screen, resulting in instant international transactions.

3.9 Messaging and Support

Another crucial aspect is assistance. If a consumer ever has any issues, they may immediately get in touch with the help desk.

3.10 Additional Features

Because of this flexibility, you may tailor your money transfer service to better meet the needs of your company and its clients. Referral programs, reward points toward utility bills, etc., are all doable additions. A lot of thought needs to go into making a money transfer app.

4. Important Things to Consider Before Developing a Money Transfer App

Here are some important things to consider for developing secure money transfer applications,

4.1 Regulatory Compliance

A payment app is not considered a bank unless the bank has its own mobile banking app, but it must nonetheless follow certain rules while dealing with its users’ money. Furthermore, rules differ between regions, necessitating that a global app meets all financial criteria anywhere it is used.

4.2 Security

Security is paramount for any application in the financial technology sector, and money transfer apps, which do more than just move money, are particularly vulnerable. If you want to keep your customers’ money and information safe while also minimizing the risk of fraud, you should employ robust data protection solutions.

The following measures should be taken to safeguard your money transfer app development:

- Create a Two-factor authentication feature.

- Regular password updates are recommended.

- Cards that meet PCI DSS requirements.

- The anti-money laundering (AML) and “Know Your Customer” (KYC) processes might benefit from the use of third-party identity verification services.

- Encrypt information, set time restrictions on sessions, create backups and set up alarms.

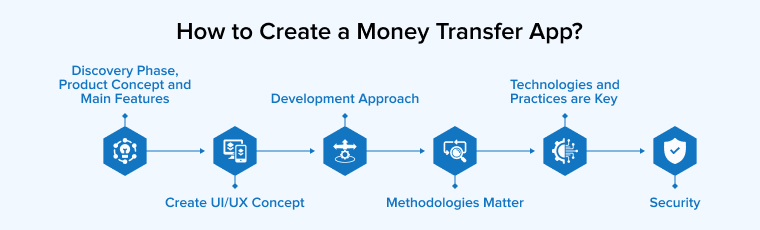

5. How to Create a Money Transfer App?

Here are some steps to be involved in building a custom money transfer application,

5.1 Discovery Phase, Product Concept, and Main Features

The discovery phase is the first and maybe most crucial step of any project, coming before even the start of the actual app development process. It will determine the course of the project and determine its eventual outcome. You’ll be able to figure out who among the company’s stakeholders has to be consulted, who that audience is, what problems your solution will address, how extensive it will be, and what features it will have. Following these procedures will aid in the development of a clear product strategy.

5.2 Create UI/UX Concept

User experience and user interface design are essential for the front end of your program, whereas your software engineers and programmers handle the back end.

You may differentiate your money transfer software from competitors and retain users with an intuitive UI and well-thought-out design. If the user has a negative interaction, they may never return. In order to understand how a user will engage with your money transfer application and complete a task like transferring funds, it’s important to create a customer journey map based on solid market research.

A well-designed product or service will provide solutions to the user’s problems and make it easy for them to achieve their goals. Customer happiness leads to more sales.

5.3 Development Approach

Once you have a firm grasp on the core features that will make your P2P money transfer software successful, you can turn your attention to building it.

- In-house Development: A solid team of developers with some background in the financial technology industry can take your product idea and run with it. Given the difficulty in assembling a team of twenty or more experts for a fintech project, it is reasonable to conclude that this choice is within the means of only the largest corporations.

- Software Development Outsourcing: Outsourcing development to financial software development companies is an alternative for organizations without the in-house expertise to create a money transfer system. After the discovery phase, the development team is working to realize the clearly envisioned product technology implementation. It’s not a quick fix, and it costs a lot more than doing it in-house.

- Using a Cloud-Based SaaS Fintech Solution: By delivering a cloud-based, API-driven transactional core, fintech firms want to shorten the time and money it takes to go from product ideas to working applications in the financial services industry. Numerous advantages set it apart from competing approaches and make it an attractive substitute for the aforementioned tried-and-true methods.

5.4 Methodologies Matter

- Agile Methodology: Agile methodology divides requests into portions and uses the feedback loop to find problems and implement solutions without disrupting the development process. It is also helpful in the organization of software lifecycle activities such as conceptualizing, planning, developing, and testing.

- DevOps Methodology: The DevOps methodology enhances software development by emphasizing teamwork among customers and project crew like project managers, designers, developers, and the operations team, and by ensuring that all projects are in line with the enterprise’s overall business goal.

- Rapid Application Development: RAD refers to a method of software development that emphasizes iterative prototyping and feedback over meticulous planning. It puts more emphasis on action than preparation. Developers can make numerous revisions and updates to the program without having to start from scratch thanks to the RAD approach.

- Scaling Agile Framework: Scaling agile framework expedites product development by enhancing quality and productivity throughout all levels, resulting in shorter delivery times. Sound connectivity, Agile methods, internal transparency, technological alignment, and the potential to have continuous upgrades are just some of the benefits of a Scaling agile framework.

5.5 Technologies and Practices Are Key

- Open-Source Development: Available for usage by the general public. The more open-source options there are, the more money you may save on deployment.

- Cloud Development: Hosting environments for developing, designing, integrating, and testing that exist on the cloud. We can manage costs and development times while maximizing access to the cloud’s many useful features. Both locally hosted and cloud-native apps can be developed.

- Artificial Intelligence: AI aids the program in mimicking human processes like learning and decision-making. To enhance the development procedure, one may use this approach. APIs and cloud services make it possible to include artificial intelligence technologies like machine learning in money transfer software development.

- Blockchain: Hyperledger technology can facilitate the development of secure transactional and financial apps using public blockchains with free software, potentially freeing up finances and accelerating business operations. Low-code development is an approach that reduces the need for code, allowing for quicker and cheaper application creation.

- Analytics Technologies: Tools for analyzing data with the use of dashboards, visualizations of financial statistics, and forecasting algorithms. The software uses APIs and AI to include analytics in its features.

- Mobile Application: A much-needed piece of equipment that, when installed on a smartphone, improves the user’s overall experience. If you aren’t already utilizing your smartphone to do Internet banking operations, you’re missing out.

5.6 Security

Most situations get difficult when security concerns arise. As we’ve already established, it’s crucial to adhere to anti-terrorist funding, money laundering, and other legislation unique to your jurisdiction. Another goal is to give consumers the most secure possible system, making it simple to stop any harmful actions. Setting up measures to verify identities, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) safeguards, as well as encryption, recovery, restores, embedded session time limitations, and similar measures, falls under this category.

Money transfer apps aren’t exactly easy to make, as you’ve probably realized. A professional software team can simplify this procedure with the help of a well-defined division of labor.

6. How Much Time Does It Take to Develop a Money Transfer App?

Developing a money transfer application is complicated. The document is divided into sections, each of which contains valuable information. Following the completion of the first discovery phase and the creation of the first wireframes, the period of technology selection and feature determination will begin for your project. As a result, you should make sure you’ve thought through the following:

- Technology: Mobile app developers employ a wide range of technologies. Focus more on developing strategies that utilize adaptable and scalable forms of technology. Technologies that are “startup-friendly,” such as Ruby on Rails, Python, or PHP, make it possible to create and expand your product without breaking the bank. On the other side, more advanced languages like Java will cost more. Technology adoption rates should be taken into account. Having access to a larger pool of skilled programmers is a perk of using widely-used languages and frameworks. Think of it as a young company whose priorities are speed and growth.

- Getting a License: Create your own smartphone app to send and receive money. To start money transfer services, you need a license to show that your product complies with the law. Candidates for a license to operate in the European electronic money sector, for instance, need a thorough business strategy, a structured organization, a solid team, and sound risk management practices, as well as the minimum necessary capital of EUR 300,000.

- Marketing: Sometimes companies put all their efforts into creating the perfect product, but neglect to market it. It’s dangerous to wait until development is complete before beginning the marketing effort. Start spreading the word to your target market as soon as you begin integrating the essential features. Advertising helps bring in new, potentially interested customers. In addition, it raises your product’s visibility and credibility among potential buyers.

- Chatbots: While chatbots have been compared to the mechanization of society, they can also provide valuable assistance in conversational AI. Software developers designed chatbots to simulate human communication in an online chat environment using either text or text-to-speech. This technology, when coupled with AI functions, may assist users 24/7.

- Legal Costs: There are additional legal fees to consider when launching a money transfer service. Many specifics regarding your product will be of interest to potential backers and buyers. Consider factors like the ease of making transfers and the safety of your funds while opening an account. An accomplished attorney can streamline the process. However, the costs vary from nation to country.

- Security: Criminals with initiative always aim for the weakest links in the money transfer system. The misuse of confidential information can have far-reaching consequences. When making a money transfer app, two-factor authentication is essential for the safety of your users. The purpose of this sort of authentication is to increase security by requiring the user to authenticate their identity in two different methods.

7. Conclusion

Applying for an MVP can help guarantee that the app will be profitable. All the essential functions of the app will be there. It’s a preview of the final product, so users can see what they may expect. Investors can woo investors with the help of the MVP, too.

Do you still need answers? At TatvaSoft, we’ve been creating software that implements conceptualized business models. And for the past 2 decades, we’ve been successful in answering practical issues. The process of developing software for moving money is intriguing, and the professionals like us can help you streamline it.

Comments

Leave a message...